How do you articulate the value your product / service offers?

During a recent project I worked with a business to map their entire product range (over 500 SKU) in the UK and Internationally.

We started by attributing competitors to each of their product categories. To ensure we did this consistently we defined a clear set of rules to ensure we matched the correct competitors each time.

Per Country

1 product category x 6 competitors (on average)

10 product categories x 100 products per category (on average)

We then needed to map our products to our competitors’ products. To ensure we mapped these correctly we once again defined a set of rules to ensure consistency on mapping as well as relying on the internal knowledge of the product team to verify that the associations were correct.

For each product we mapped the online sale price of that item, the distributor list price (if available), the cost price. We also looked at things like competitors brand equity and the features they offered.

RRP

Once we had gathered this information, we were able to calculate the average price of a specific product online (RRP), as well as identifying the lowest and highest prices in the range.

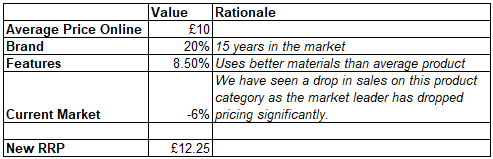

At this point we needed to then decide where our products sat against our competitors.

Do we have better features than the average product? Do these features matter to our customers?

Is our brand strong enough to enable us to charge more?

Based on our existing product pricing do we believe our price is affecting current market dynamics positively or negatively?

Taking all of this into account we then adjusted our pricing from the average using the formulae below:

New RRP = average price * (1+brand value+features+current market dynamics)

Sense Check

Compare the price to the existing RRP of our product in the market. Is it an increase or a decrease? Is this acceptable?

This is the challenging part of the process where we start to potentially see products that are overpriced in the current market.

To verify if this is the case or understand that you have potentially under valued your features or brand then you should look at your sales historically and see if the new prices reinforce the RRP decisions you made.

Set the Price in Stone

Once the RRP was agreed upon we had a price which placed us correctly in the market.

The company could clearly articulate why the product was the price that it was and the value they were offering.

List Price

When calculating list prices, we started by identifying the number of pricing tiers that the company wanted to use.

Once that was decided we created a model which enabled the Sales team to automatically adjust the margin each customer would get if they sold at RRP.

This model meant that the sales team could not only see the margin each customer got but also could see the corresponding margin they received.

We defined a set of criteria which had to be met to get to each tier that was defined and this brought further transparency to their customers.

Modelling

Once the list prices were agreed we built a model based on the last 12 months’ worth of sales allowing us to see the affect it would have on the revenue and margin of the company if the sales stayed the same in the next 12 months. This model went down to product level rather than a flat % increase.

Once this model was complete, we presented the results to the senior team to validate and sign off.

In summary, some of the product groups saw an increase in price but some saw a decline.

This methodology enables a business to place their products accurately in the market based on what their competitors are doing.

If you would like to discuss this methodlogy or would like to find out how it could help your business then get in touch.